What are the benefits of Debtor Finance?

- Optimising your business' cashflow and liquidity.

- Eliminate delayed payments by getting paid by your debtors at issuance of invoice (*Invoices funded up to 60 days after issuance).

- Domestic or offshore invoices are accepted.

- Limits from $100k to $4m.

- Single or multi debtor facilities.

- Faster conversions from invoice to cash.

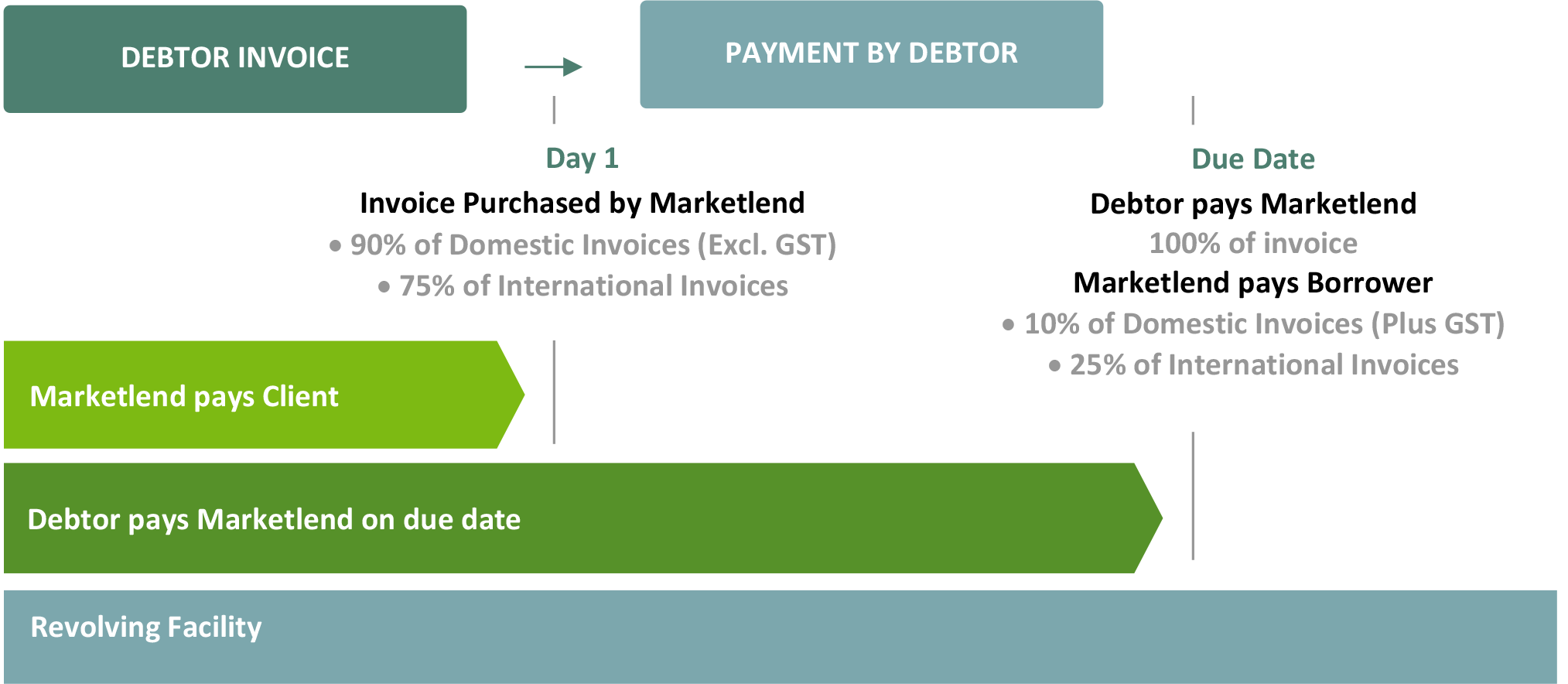

- Revolving facility allowing you drawdown, repay and redraw.

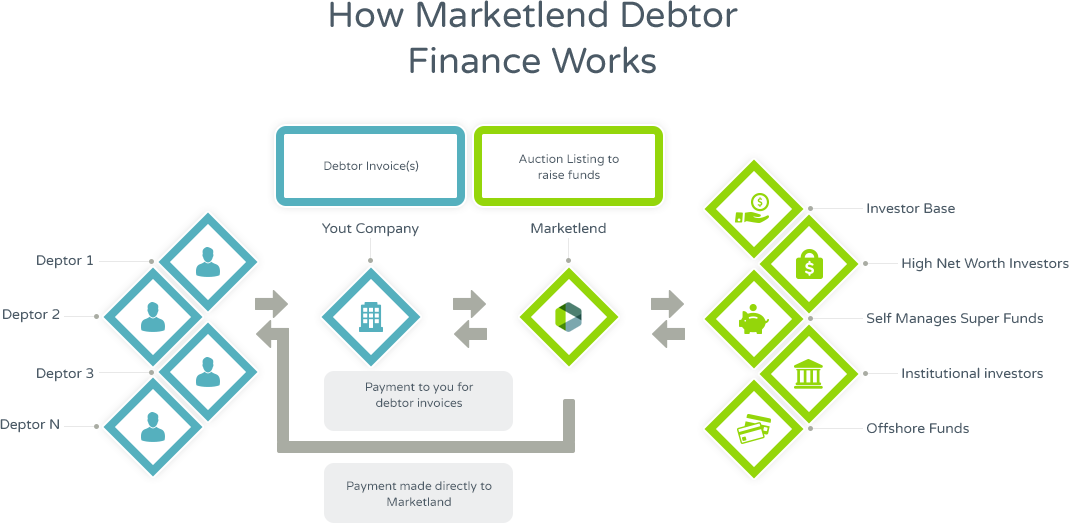

How it works

-

You issue to your Debtors an invoice for goods or services provided

-

You submit to Marketlend the invoices for credit insured Debtors

-

Marketlend pays you 90% of your domestic Debtor Invoices (excl. GST) or 75% of your international Debtor Invoices

-

On the Invoice due date the Debtor pays Marketlend

-

Upon receipt of payment: Marketlend pays the 10% balance for domestic invoices or the 25% balance for international invoices

Am I eligible?

- Do you offer credit payment terms to your customers?

- Are you a registered company?

- Have you traded for 12 months?

- Do you have good credit history?

- Are your debtors established companies with good credit history?