How Marketlend works

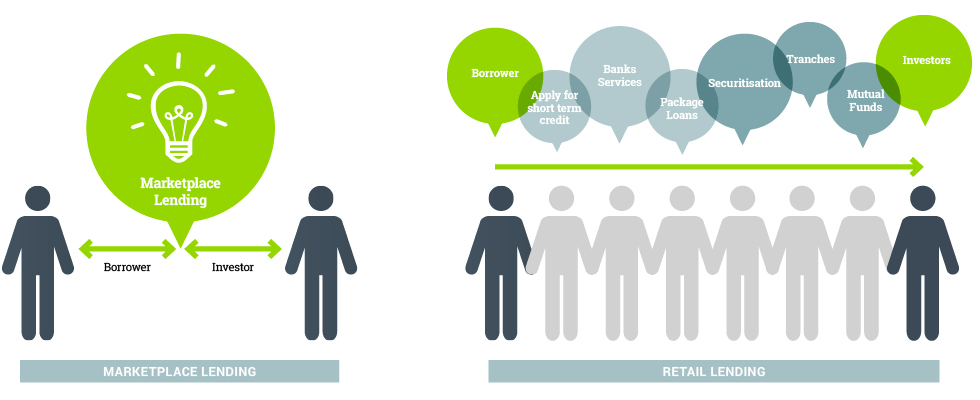

Marketlend provides a stable online platform. This is underpinned by protection against loss and fraud. To achieve this we undertake credit checks, establish a grading of expectation of repayment, and facilitate the administration of the loan. This enables us to quickly provide borrowers with access to capital that is normally earmarked for investment with banks, and investors with access to sound investment opportunities.

Transparency is our thing

We charge a platform fee to provide a platform that does all the processing of the investment and mitigates the risk. All transaction costs are also transparent and typically lower than traditional bank loans. This means if you are a borrower, you get lower rates or if you are an investor, potentially stronger returns. There is no reward without risk. However, Marketlend minimises the risks wherever possible.

Investment protection

Marketlend uses the best possible legal protection in this emergent marketplace. This legal protection was well proven throughout the recent global financial crisis. Investors are protected by the fact that Marketlend is the first peer to peer lender to secure every loan in a securitized special purpose company, or trust protected by an independent trustee, Australian Executors Trustee Limited. The IOOF group has been helping Australians secure their future since 1846 and manage and administer more than $121.9 billion of client monies (as at 30 June 2014), and are listed on the Australian Securities Exchange in the ASX top 100 (ASX:IFL).

What does this mean?

It means you have a secured beneficial right in a special purpose company or a secured note with a trustee, an independent company controlling the assets and all monies. Where a trust is used, loans are held in separate legal trusts, or in the case of a special purpose company, it is structured so to protect it from becoming insolvent. All payments have a set payment structure so there is no possible misappropriation, and Marketlend’s parent Tyndall Capital does not process or handle any of the borrowers or lenders money.

Furthermore, Marketlend, a subsidiary of Tyndall Capital Pty Ltd, is constituted as a bankruptcy remote corporate.